Considerations for Getting the Best Auto Warranty

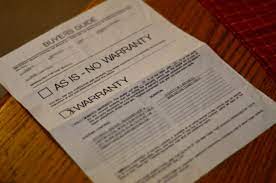

Buying an extended warranty can save you money if the car breaks down. But not all warranties are created equal.

Look for perks like roadside assistance and rental car coverage, and read sample contracts carefully. Check out the customer review scores on Trustpilot, Google and the Better Business Bureau.

Purchasing a bumper-to-bumper or powertrain warranty can ease financial stress if you need to make a costly repair. But choose your provider wisely.

Coverage

Some automakers offer a factory warranty on their vehicles that lasts for several years and covers many of the most costly repairs. For example, Ferrari owners receive four years or 50,000 miles of bumper-to-bumper coverage, and Rivian electric vehicle (EV) buyers get eight years of powertrain protection.

If you’re interested in an extended warranty, look for one that covers a wide range of repairs and has a low deductible. In addition, look for a company that lets you choose your own repair shop and handles claims in-house instead of outsourcing them to a third party.

Endurance Warranty Services offers three plans that cover most of the components in your car, including high-tech systems and suspension components. Its Platinum Plus plan covers almost everything but a few “wearable items,” while its Gold and Silver plans are more affordable. Its warranties are backed by AmTrust Financial Services and its customer service is top-notch.

Deductibles

When comparing car warranty providers, consider their deductible options. A deductible is an amount you have to pay out-of-pocket before the plan kicks in to cover repairs. A plan with a higher deductible will typically cost more than a lower-deductible option.

You’ll also want to pay attention to a provider’s terms and conditions, including maintenance requirements and exclusions. For example, some extended warranties require that you keep detailed service records or else they may not be valid. Others exclude repairs for cars with certain technology, such as voice activation systems or advanced seat controls.

Whether or not an extended warranty is worth the investment depends on your level of risk and how much you want to protect yourself from expensive repair bills. Ultimately, a comprehensive car warranty can save you thousands of dollars over the years. Consider researching multiple plans and negotiating pricing. You have little to lose and much to gain by doing your homework. A good place to start is with a trusted independent mechanic who can help you compare options. You should be able to find one that will meet your specific needs.

Requirements

As with most products, warranties vary by provider. The most important differences are coverage, deductibles and warranty duration.

When choosing a warranty, it’s crucial to read the contract carefully to see what’s included and excluded. Then shop around to compare prices and features. Look for a plan that requires your repairs to be performed at the dealership, and uses OEM replacement parts. That will ensure the work is done right.

You should also avoid buying a warranty from a company that brokers these plans. Companies like CarShield and American Auto Shield are not the actual providers of these warranties, and they can charge you more for them.

The best way to protect your wallet is to buy a new car with an excellent factory warranty. Most new cars come with bumper-to-bumper and powertrain coverage for a specified period of years or miles, plus specific warranties for rust, emissions equipment and hybrid or electric vehicle batteries.

Limits

While all warranties are essentially vehicle service contracts, not all are created equal. Some providers limit the types of repairs they will cover, such as requiring that the repair be done at their approved facilities or using only original equipment parts. Others exclude routine maintenance items like oil changes, filter replacements and fluid top-offs.

The vehicle type and manufacturer may also impact the cost of a plan. Generally, luxury vehicles and those with higher mileage will cost more to cover because they are more likely to need repairs than less expensive models.

Many plans have a 30-day/1,000-mile waiting period to prevent car owners from trying to game the system by purchasing the warranty right before their vehicle breaks down. Those who want to avoid this expense should look for a provider that offers a wait-free policy. Similarly, most providers include perks in their plans, such as 24/7 roadside assistance and reimbursement for rental cars. Lastly, consumers should compare the costs of each provider side-by-side to determine which offers the best value. This can be done by looking at the level and duration of coverage, deductible options, revocation/transfer policies and transfer fees.